UnitedCrowd

UnitedCrowd is a digital financial instrument network

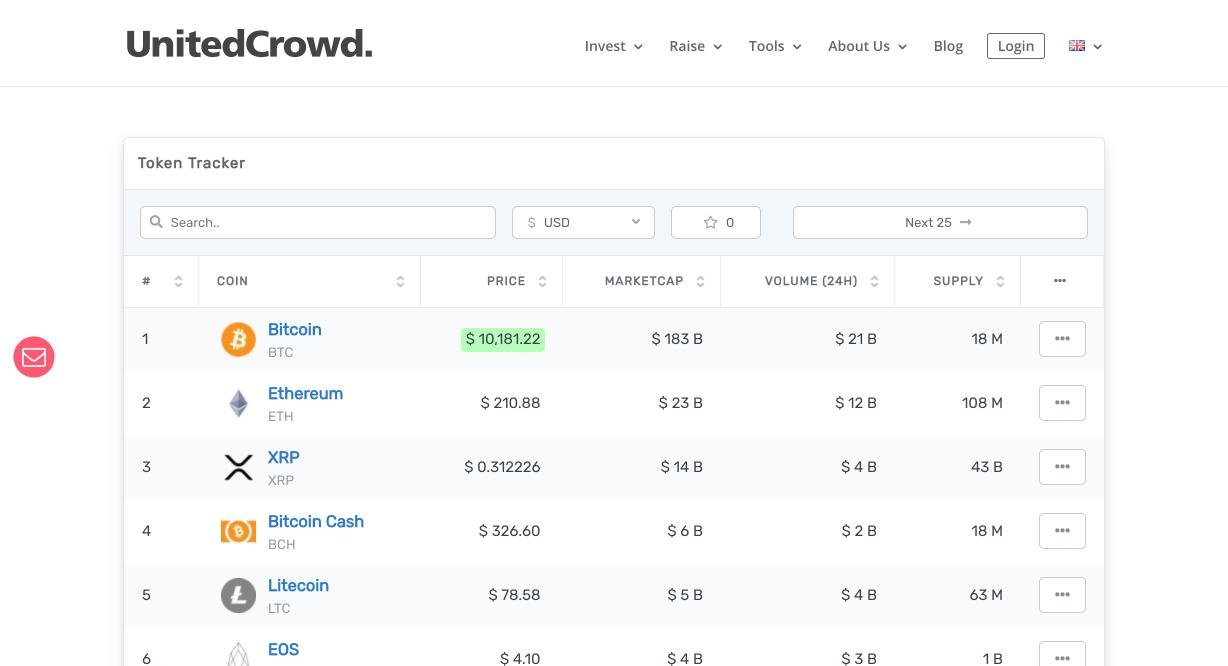

UnitedCrowd is a digital financial instrument network. By using the Tokenization Platform, they can offer digital financial products - for corporate finance, for example. Its architecture makes it possible to develop and optimize financial products based on blockchain technology using a smart template-based conceptual framework, called smart contracts, which are then distributed as tokens.

UnitedCrowd is a platform for digital financial instruments. With our Tokenization Framework, we can issue digital financial products - for corporate finance purposes for example. This framework makes it possible to model financial products based on blockchain technology and automate them through a template-based smart contract model, which is called a smart contract which is then mapped as a token. In close cooperation with regulatory authorities, all contracts are validated for compliance with country specific regulations. In order for the token to fulfill its intended purpose and bring all stakeholders together, the various processes must be dynamically interlinked and provide different examples with their own access rights.

UnitedCrowd, a platform for attracting investment in new projects, will help you understand this difficult problem. Here you will find ample opportunities to grow your project and attract initial investment for further development.

UnitedCrowd is an official platform registered in Germany, so you don't need to worry about wasting time using the service, and here you will get maximum security when making transactions. UnitedCrowd only works with qualified and trusted investors and will help you find the right investors, in fact, taking all the work to fund your project.

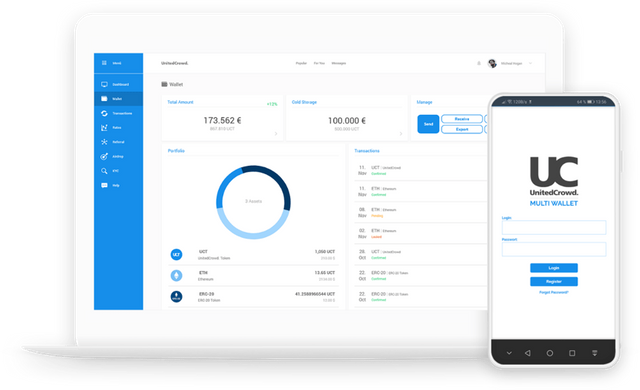

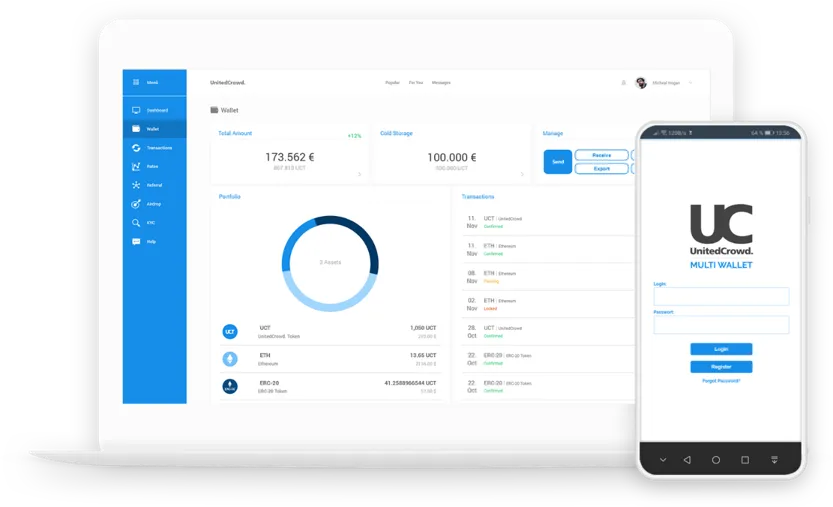

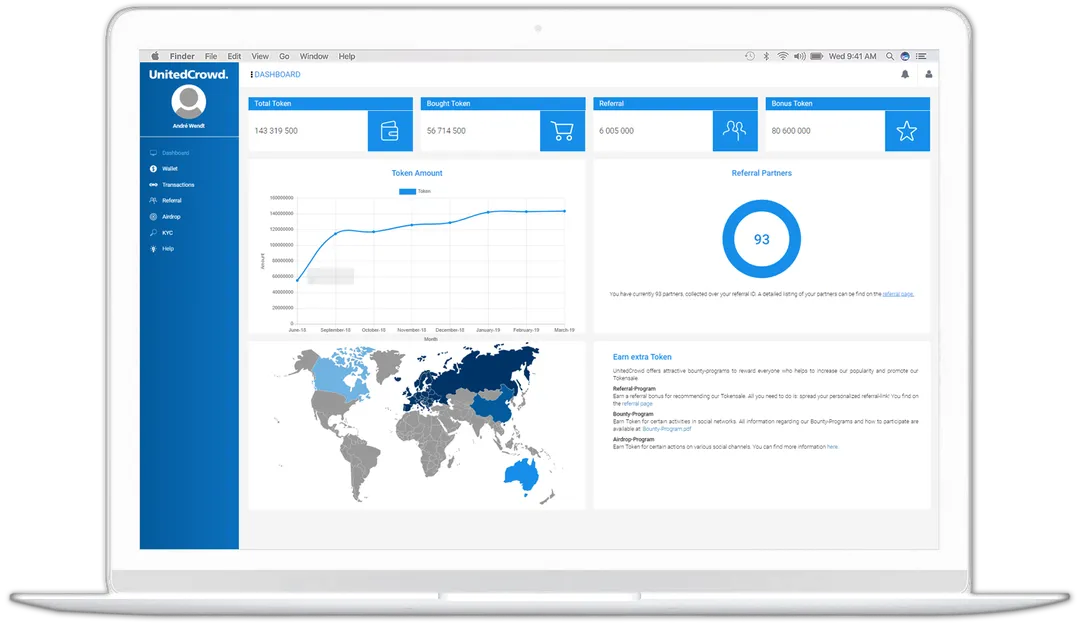

On the UnitedCrowd platform, you can track the fundraising process for your project around the clock. Very comfortable and intuitive interface of the software application will be understandable even by inexperienced users. The design will not leave you indifferent)

I would like to highlight some of the advantages of the UnitedCrowd platform. Here you will be asked to

Individual layout following means you will be helped to develop interface layout according to your parameters and needs.

UnitedCrowd operates on a blockchain network and therefore reliably protects your data.

All material related to your project will be available for potential investors to view via the platform.

All UnitedCrowd investors are vetted and verified.

Layers and components

● Residential layer

The finishing layer includes all on-chain elements of the framework. There, the assets are automated via smart contracts and initialized as tokens. Different financial instruments each have their own requirements for tokens and are differentiated into different token classes depending on the product. The settlement layer also forms the basis for calculating prices based on statistical pricing models that take into account risk, dividend payouts, market conditions, and other elements that are unique to each token. In addition, a risk reduction mechanism is provided through hedging protocols, which are required for various models against default risk.

● Layers of confidence

The trust layer governs compliance and data validation and defines the structures and processes to ensure that legally and ethically binding rules are included. Validating compliance with legal and financial regulations is a key requirement, aiming to provide flexible response and protection for right-holders. Consistent identity protocols for the collection of the personal data of issuers, investors and companies are essential and defined by law. Securing token ownership and possible transfer, as well as adapting to new legal regulations are possible both in a centralized form by the issuer and in the form of "distributed governance" by stakeholders. Consensus protocols are the key to the allocation of rights,

● Service layer

The service layer provides the interface for off-chain communication. Data exchange is carried out through Oracle and DAPP, which ensure communication via the frontend and with a communicative function, distributing either read-only or control functions to different role holders. As a key component of value provision outside the chain, a solid "data intelligence layer" provides the interface for analysis and information. In addition to KYC / AML regulations, different off-chain data or compliance models can be provided for different assets

In conclusion, we can say the following.

If you are developing a unique product online and trying to find investors, then UnitedCrowd is perfect for you. UnitedCrowd, registered in Germany, makes all transactions as safe as possible.

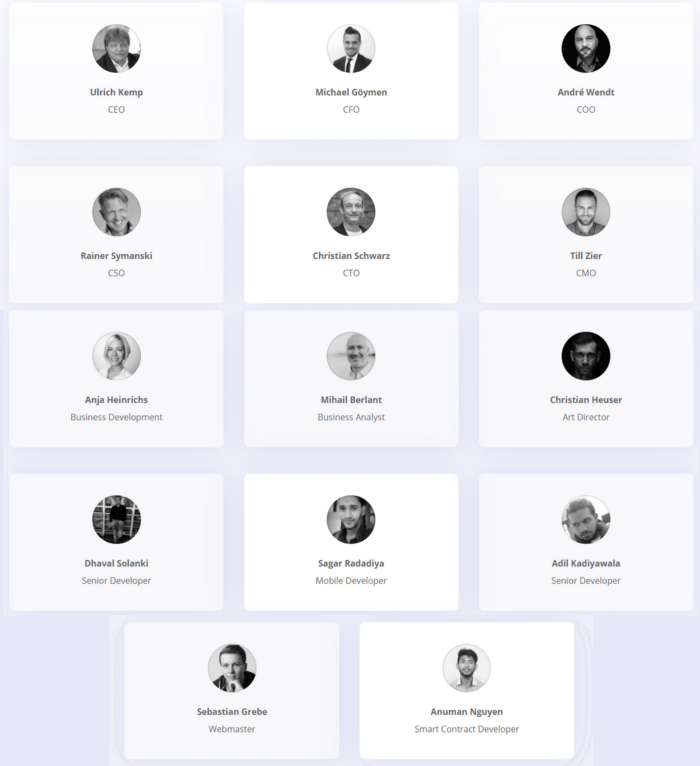

The UnitedCrowd development team consists only of highly qualified specialists and experts in their fields, all of them are public and available on social networks (you can get to know the composition of the team by visiting the official website).

You can find out more about the UnitedCrowd platform on the official website. Also, in order not to miss news and updates in the project, subscribe to projects on social networks.

You can ask questions to the development team in the official Telegram groups.

Issuance of tokens

Compliance with the legal framework and regulatory mechanisms is guaranteed both off-chain and on-chain.

1. Review of the publisher

Before UnitedCrowd created digital financial products, we checked publishers against questionable and evaluated fixed parameters. This includes, for example, due diligence, corporate governance and security, but also management, which, among other things, goes through standard checks and background checks on integrity and reputation risks.

2. Choice of financing type

If the requirements are met and we are confident in the sustainability of the project, the decision on the type of financing follows the second step. With the Tokenization Framework, different values can be digitized with all the rights and obligations contained therein. Depending on the requirements and objectives of the company, these variants have different suitability.

Thus the following classifications become relevant:

● Asset Token (financial asset)

Both liquid and illiquid assets can be represented as securities that are tokenized by Asset Tokens. In this way, they can be converted into digital and proportional fractional ownership (partnerships) and can be accessed by international markets. The spectrum includes everything from cash, cash equivalents, savings accounts, real estate, precious metals or art objects to intangible assets such as patents, copyrights or trademark rights.

● Token equity (stock)

Equity tokens can represent shares in a company and voting rights, as well as shares in funds.

● Debt Token (the right to claim)

The token represents a debt claim for repayment of the amount invested with or without interest. The range includes bonds, loans and bonds.

● Utility tokens (service and usage rights)

Utility tokens represent usage rights and can be used, for example, to provide access to the network as a community token or to receive goods or services offered by the token issuer.

What are the benefits of tokenization with UnitedCrowd?

Tokenization has several advantages which we will highlight below:

- 24/7 market

- Fractional ownership

- Fulfillment

- Cost reduction and intermediaries

- Transmisi peer-to-peer

- Fast procesing

- Programabilitas

- New financial product

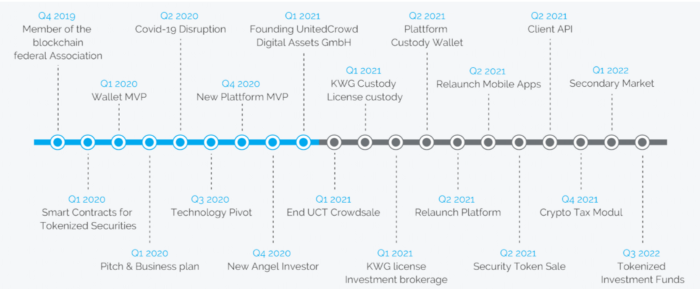

Roadmap

Tim.

UnitedCrowd project partner

Further information:

● Website: https://unitedcrowd.com/

● Facebook: https://www.facebook.com/UnitedCrowd/

● Twitter: https://twitter.com/unitedcrowd_com

● Telegram: https://t.me/UnitedCrowd

● Linkedin: https://www.linkedin.com/company/unitedcrowd/

● Instagram: https://www.instagram.com/unitedcrowd_com/

● Youtube: https://www.youtube.com/c/UnitedCrowd

● Media: https://medium.com/@unitedcrowd

Username belguso Link: https://bitcointalk.org/index.php?action=profile;u=2633296

Komentar

Posting Komentar